This is a basic guide, prepared by ACCA’s Technical Advisory team, for members and their colleagues or clients. It’s an introduction only and should not be used as a definitive guide, since individual circumstances may vary. Specific advice should be obtained, where necessary.

The message from the Chancellor was that this is a Budget with three aims:

- protecting the jobs and livelihoods of the British people

- strengthening the public finances

- supporting an investment-led recovery

You can read the individual measures and details of some of the numerous consultations below.

Rates and allowances

Capital gains tax annual exempt amount (after personal allowance)

These are frozen at £12,300 for individuals and £6,150 for trusts.

Dividend allowance

The tax-free dividend allowance is unchanged at £2,000.

Corporation tax

The corporation tax rate will remain at 19% but from April 2023 the applicable corporation tax rates will be 19% and 25%. Businesses with profits of £50,000 or below will still only have to pay 19% under the small profits rate.

Grants – restart

‘Restart Grants’ are available in England of up to £6,000 per premises for non-essential retail businesses and up to £18,000 per premises for hospitality, accommodation, leisure, personal care and gym businesses

Grants – export

The SME Brexit Support Fund grant provides up to £2,000 to help with training or professional advice.

Enhanced capital allowances: super deduction

This introduces increased reliefs for expenditure on plant and machinery. For qualifying expenditures incurred from 1 April 2021 up to and including 31 March 2023, companies can claim

in the period of investment:

- a super-deduction providing allowances of 130% on most new plant and machinery investments that ordinarily qualify for 18% main-rate writing-down allowances

- a first-year allowance of 50% on most new plant and machinery investments that ordinarily qualify for 6% special rate writing down allowances

Annual investment allowance (AIA)

Companies will be able to claim £1m as AIA for expenditure incurred from 1 January 2019 to 31 December 2021. The announcement was made in November and before the ‘super deduction’.

Apprenticeship funding

Apprenticeship incentive payments for employers will increase to £3,000 per new hire until September 2021.

Making tax digital (MTD)

There were no announcements on MTD except that the government will publish an evaluation on the introduction of MTD for VAT, expected on 23 March.

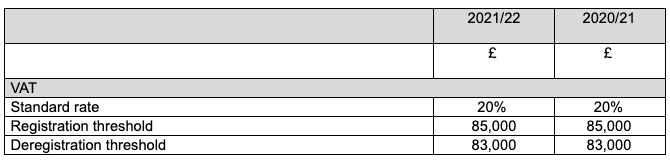

VAT

VAT deferral

Businesses with outstanding VAT from last year may join the VAT deferral new payment scheme to spread their payments. The online service is open until 21 June 2021.

Coronavirus Job Retention Scheme (CJRS)

An extended version of the CJRS provides further support for employees until the end of September 2021.

Self-Employment Income Support Scheme (SEISS)

A fourth grant will open from late April and will be available until 31 May 2021, and will include those self-employed in the tax year 2019/20, with the SEISS being available for a 5th grant until September 2021 based on turnover.

Losses

Trading losses will have more flexibility to carry them back over three years. This applies only for losses incurred by companies for accounting periods ending between 1 April 2020 and 31 March 2022, and for individual for trade losses of tax years 2020/21 and 2021/22.

Entrepreneurs’ relief

The lifetime limit on gains eligible for entrepreneurs’ relief is £1m for qualifying disposals.

Employment allowance reform

The allowance is £4,000 but continues to be limited to employers with an employer NIC bill below £100,000 in the previous tax year.

Statutory sick pay (SSP)

Small and medium-sized employers across the UK will continue to be able to reclaim up to two weeks of eligible SSP costs per employee. As with other pandemic-related business support schemes, the government will set out steps for closing this scheme in due course.

Apprenticeships

SMEs should register on the apprenticeship employer hub before the end of the month to benefit from apprenticeship levy funding. You can find out more about ACCA Apprenticeship Programmes.

R&D

From 1 April 2021, SMEs applying for R&D tax credits will be eligible to a maximum of £20,000 in repayments per year plus three times the company’s total PAYE and NIC liability.

Inheritance tax (IHT)

The nil-rate band remains at £325,000. The residence nil-rate band for deaths in the following tax years are:

£100,000 in 2017/18

£125,000 in 2018/19

£150,000 in 2019/20

£175,000 in 2020/21

£175,000 in 2021/22

Time to pay

Taxpayers can set up a payment plan online via GOV.UK.

Pensions

The pension lifetime allowance will remain at its current level of £1,073,100 until April 2026.

Rates

100% relief for businesses in retail, hospitality and leisure in England continues until June 2021. From July 2021 to March 2022, these business will pay a reduced rate of 33%. Businesses in England closed due to national lockdowns from 5 January 2021 onwards, or between 5 November and 2 December 2020, may be eligible for grants.

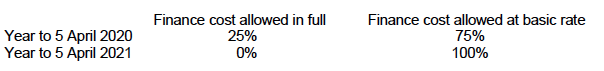

Interest relief for landlords

Landlords will be able to obtain relief as follows:

Non-UK residents are to pay 2% surcharge SDLT on residential property purchases from April 2021. The SDLT nil-rate band of £500,000 for residential property purchases in England and Northern Ireland will be extended to June 2021, reducing to £250,000 from July to September and reverting to £125,000 from October 2021.

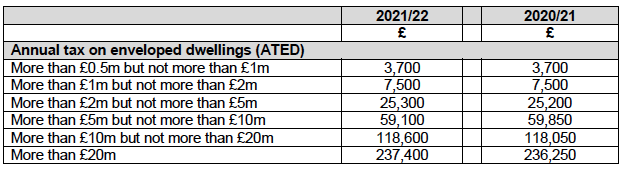

Annual tax on enveloped dwellings (ATED)

The ATED charges increase automatically each year in line with inflation (based on the previous September’s Consumer Prices Index).